Synthetic Data - A Double-Edged Sword

There’s another thread getting pulled in financial services: while data powers innovation, regulations and trust keep us cautious. When wealth and asset managers apply AI solutions, they do it knowing client confidence is the anchor. Synthetic data steps in where real data can’t safely go—it opens doors for model development, speeds experimentation, and fortifies privacy. In my view, this is the future path for responsible AI - but only if it is done right.

“Life in plastic, it’s fantastic”

Synthetics are everywhere - in our clothes, our food, and now in our data too. But it’s not all bad. Imagine Spandex: elastic, resilient, and transformative, enabling comfort and movement in sportswear and business apparel.

Synthetic data too carries a similar promise for AI - helping us stretch boundaries and simulate outcomes, adapt to unobserved events. Like blended fabrics, the aim is to enhance function and innovation, but the wrong mix can have it’s unintended effects.

So what is Synthetic Data in Financial Services?

Simply put - Synthetic data is generated by computers to resemble real-world data in pattern and structure.

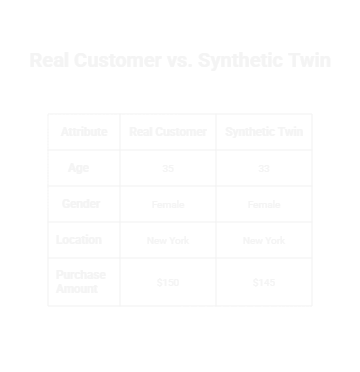

Here’s an example side by side

See the problem? The synthetic data could be a real row from a customer table, or completely made up.

The example above is a simple one. Real-world synthetic data is richer, with Personally-Identifiable Information such as SSNs, Digital Identifiers like IP addresses, and so on.

Models need customer histories and transaction details, so to counter data sharing risks, AI teams can create data “twins” for customer records. These are generated by machines to echo real-world patterns.

Now comes the risk management perspective:

How can we reduce bias and protect privacy without sacrificing innovation? Rigorous validation ensures synthetic datasets truly represent real-world patterns, catching anomalies before AI models learn from flawed data. I’ve found 3 methods to work well with AI and Data Teams.

1. Statistical Similarity Checks

Banks generate synthetic transaction data that maintains key statistical properties of real customer data. For example, if the original dataset shows that most customers spend under $100 per transaction and have occasional peaks on weekends, the synthetic set should reflect these patterns. Financial institutions compare metrics like average transaction amount, frequency, and correlation between spending categories to ensure synthetic data realistically mimics customer behavior. This helps AI models trained on synthetic data behave accurately once deployed.

2. Model Utility Testing (Train-on-Synthetic, Test-on-Real)

Fraud detection models benefit greatly from synthetic data because genuine fraud cases in training data are rare. By creating synthetic fraudulent transactions mirroring real fraud patterns, such as unusual merchant locations or transaction timings, banks can train more balanced models. These models are then tested on real transaction data to confirm their ability to detect genuine fraud.

3. Privacy Risk Assessment

Synthetic data must not expose any actual customer details. Privacy assessments evaluate re-identification risks using methods like membership inference attacks or similarity searches. In personalized finance, synthetic datasets are scrutinized to confirm zero chance of tracing transactions back to an individual’s account. By deploying privacy-preserving synthetic data generation platforms, banks can safely share insights across teams or with partners without violating strict financial privacy regulations.

Together, these validations ensure synthetic data is both ethically safe and practically useful, enabling advances in personalized finance such as tailored credit scoring, fraud analytics, and customer behavior modeling without compromising privacy or accuracy.

Bottom-line:

Data leaders who implement these three validation methods can accelerate AI innovation while meeting increasingly strict privacy regulations. This approach transforms compliance from a barrier into a competitive advantage, enabling secure data sharing across teams and with partners without regulatory exposure.

The result: faster time-to-market for AI-driven financial products with built-in trust and transparency.

Further Reading:

https://en.wikipedia.org/wiki/Synthetic_data

https://www.snowflake.com/en/fundamentals/synthetic-data/