Davos 2026: AI Sovereignty Is Becoming a Competitive Operating Requirement

Davos 2026: AI Sovereignty Is Becoming a Competitive Operating Requirement

A practical interpretation for financial services, with a fictional Tier 1 bank case study

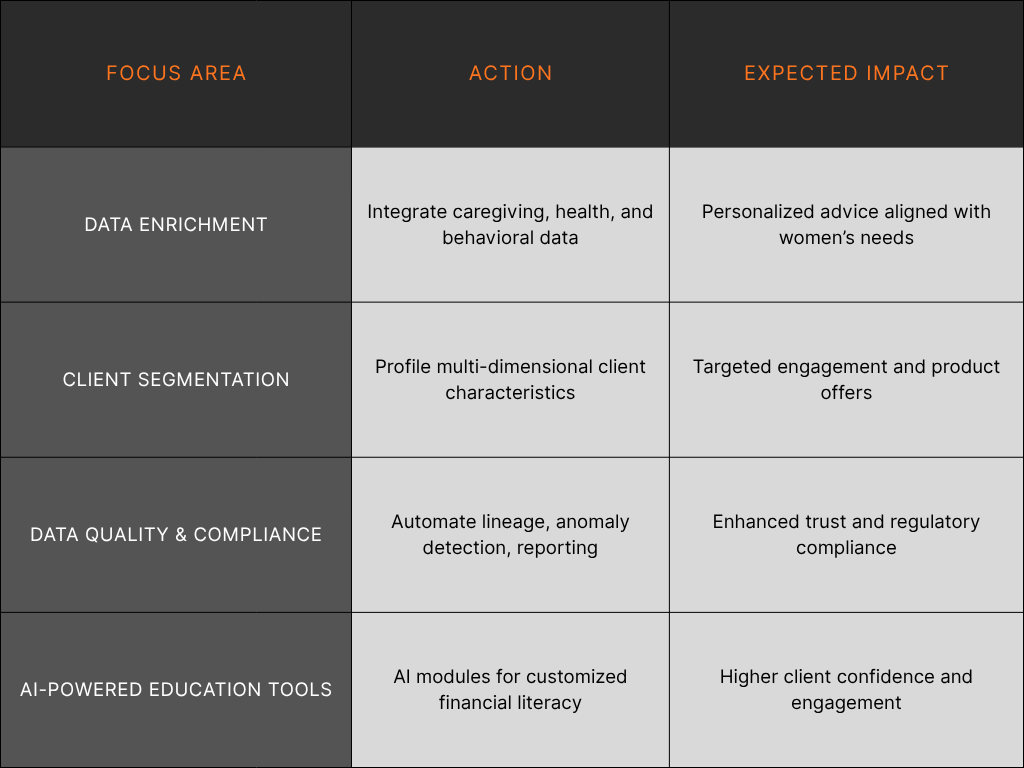

Davos is reframing AI sovereignty as competitive control, resilience, and optionality. Here is how a Tier 1 financial institution can operationalize it, without chasing full-stack ownership.

A quick primer on Data-Driven Decision-making in Wealth Management

Explore how wealth management firms can unlock true value by advancing through the DIKW pyramid—building from raw data to actionable wisdom. Learn practical steps to improve data quality, analytics, compliance, and decision-making for a future-ready financial practice.

Preparing for the demographic shifts in generational wealth transfer

wealth management, financial advisory, data strategy, AI governance, wealth transfer, women inheriting wealth, personalized financial planning, regulatory compliance, asset management consulting, Snowflake data platform, responsible AI, financial data quality

You can’t outrun a data mess

Discover why strong, high-quality data foundations are essential for successful AI initiatives. Learn how bad data quality slows AI progress, the role of data governance, and the deep connection between trusted data and AI ROI. Empower your AI projects by investing in resilient data quality practices and governance frameworks to avoid costly bottlenecks and trust erosion.