Preparing for the demographic shifts in generational wealth transfer

A very interesting insight caught my eye the other day. We know that there is an estimated USD 124 trillion in assets set to be transferred from older generations to younger ones in the U.S. by 2048.

But if you dive into the data, one demographic stands out - women.

Power is shifting within households and purchasing power patterns are ever-changing in the economy. Women are increasingly inheriting and controlling wealth. Public data from the Certified Financial Planner (CFP) Board's 2025 report, Building Wealth: Insights on Women’s Aspirations & Growing Financial Power, reveals that women’s economic influence is surging, reshaping wealth management imperatives. By 2023, women’s economic power was projected to reach $34 trillion. Wealth transfer to younger generations positions them as primary decision-makers and asset holders. As this wealth transfer accelerates, estimated at $84 trillion (a lioness share of the pie!) across generations through 2045, wealth management firms and their data teams must proactively adjust strategies to meet the financial priorities and behavioral characteristics unique to women clients.

Understanding this Wealth Shift with data

Women’s labor force participation climbed from 43.0% in 1969 to 57.3% in late 2024, rising while men’s participation declined. Educational attainment among women has surpassed men, with 47% of women aged 25 to 34 holding bachelor’s degrees compared to 37% of men. These educational gains are critical since higher education correlates strongly with lifetime earnings and wealth. For example, a 2021 Georgetown University report found that women with bachelor’s degrees earn a median of $2.4 million over their lifetime compared to $1.3 million for women with only a high school diploma.

These trends have culminated in women controlling a growing share of U.S. wealth. Estimates suggest women held one-third of financial assets in 2019. The Bank of America Institute, a public think tank, forecasts that approximately $30 trillion will transfer specifically to younger women, dramatically elevating their financial influence in the years ahead.

So what are our priorities?

Women’s financial priorities often extend beyond traditional wealth accumulation to include caregiving responsibilities, emergency savings, and retirement security. The CFP Board report highlights that more than two-thirds of women surveyed serve as primary investment decision-makers within their households. Women tend to prioritize:

Comfortable retirement savings and not outliving their money (83%) - Check

Increasing retirement savings (71%) - Check

Maintaining sufficient emergency funds (68%) - CHECK!

Managing healthcare and long-term care costs (45%) - Check (Someone’s gotta budget for that Oura Ring subscription!)

While women display confidence in managing day-to-day finances such as budgeting, bill-paying, and debt management, they also seek professional guidance with investing, estate planning, and wealth building.

Financial planners are highly needed, with 56% of women stating that they rely on financial planners to achieve their financial goals. A hands-on approach works better, despite increasing levels of fintech automation.

What are the implications for Wealth Management Data Teams/ Data Offices

Key considerations include:

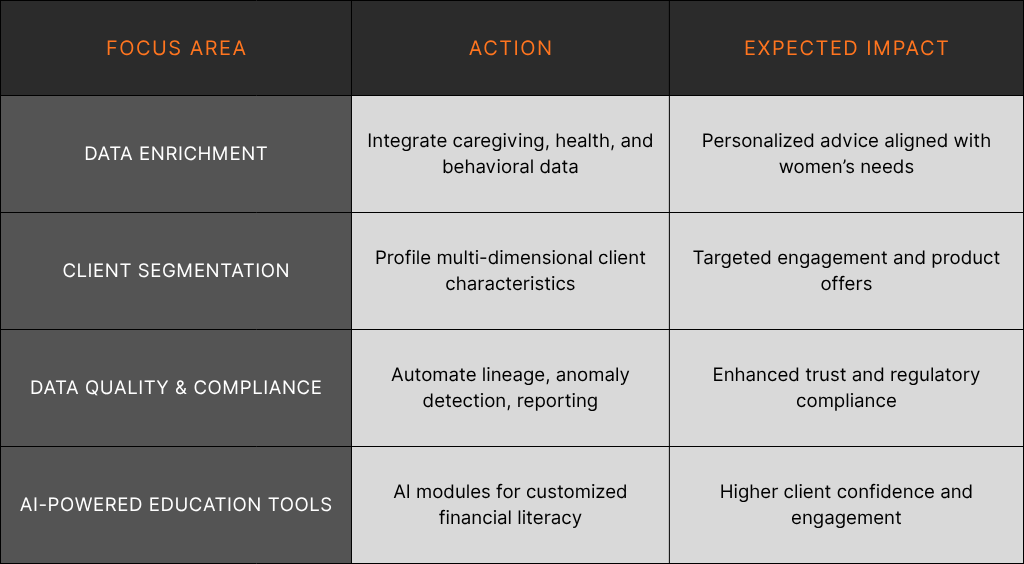

Client Data Enrichment with Behavioral Insights: Incorporate data sets and analytics that reflect women’s unique financial behaviors - caregiving costs (Care.com?), health-related expenses, tax considerations, and philanthropic interests - to enable personalized advisory services.

Enhanced Segmentation and Personalization: Develop advanced segmentation schemas in platforms like Snowflake and Data Catalogs that distinguish clients not only by assets but also by caregiving roles, risk tolerance linked to retirement concerns, and financial knowledge confidence levels.

Robust Data Quality and Compliance Controls: People increasingly relying on transparent, trusted advice meaning post-trade - there is a need to defend data accuracy and lineage for regulatory compliance (SEC, FINRA) and client trust. Embedding AI-driven quality checks and compliance automation can streamline oversight and reporting.

AI-Assisted Education and Engagement Tools: Deploy AI-driven insights and customizable content modules supporting women’s aspirations for education on investing and wealth building to cultivate confidence and deepen engagement.

Privacy and Ethical AI Governance: Given the sensitive nature of caregiving and personal finance data, wealth firms must rigorously apply AI governance frameworks aligning with principles from NIST, IEEE, and OECD to ensure fairness, transparency, and compliance. An ethical complication can arise if credit decisions are skewed due to an individual caregiving demands.

Let’s takeaway a practical checklist for Data Teams

Non-exhaustive list

So….what are some takeaways?

Analytics, Business, and Data teams should discuss, at minimum:

How well do our client data frameworks capture the nuanced financial realities of women clients, including caregiving and health concerns?

Are our AI tools and compliance frameworks aligned with the latest ethical standards to avoid unintended biases?

How can we innovate our financial education offerings to meet women’s expressed desire for knowledge and empowerment?

What would an implementation case study (hypothetical, illustrative example) look like?

Let’s look at AI Governance and Data Strategy in Action at a Large Wealth Manager (hypothetical, illustrative example)

Context: A leading wealth management firm serving high-net-worth clients is embarking on a transformation project integrating cloud data warehousing and a name-brand data catalog for data governance. They deployed GitHub Actions to automate data quality checks and compliance workflows. The adoption of AI-powered predictive analytics enabled hyper-personalized investment recommendations, aligned with client risk profiles.

To meet SEC and FINRA scrutiny, the firm implemented an AI governance framework based on NIST guidelines, ensuring transparency and auditability in AI outputs. Rigorous third-party reviews of AI vendor platforms mitigated data privacy and operational risks. This integrated approach reduced compliance incidents by 30%, improved client satisfaction scores, and drove a 15% revenue uplift via new client acquisition and retention over 18 months.

Of course, implementation realities are different. But this is a decent baseline for firm strategy.

Preparing now ensures wealth management firms are not only compliant and operationally effective but also best positioned to support the next generation of financially empowered women.

Further reading/Materials Referenced are publicly available resources.

Fortune, 2025. The $124 trillion Great Wealth Transfer is bigger than ever [Online]. Available at: https://fortune.com/2025/07/23/great-wealth-transfer-124-trillion-bigger-than-ever-millennials-gen-x/ [Accessed 11 October 2025].

Cerulli Associates, 2024. Cerulli anticipates $124 trillion in wealth will transfer through 2048.

CNBC, 2025. Most of $124 trillion 'great wealth transfer' will go to women [Online]. Available at: https://www.cnbc.com/2025/03/12/most-of-the-124-trillion-great-wealth-transfer-will-go-to-women.html [Accessed 11 October 2025].

Certified Financial Planner Board, 2025. Building Wealth: Insights on Women’s Aspirations & Growing Financial Power [Online]. Available at: https://www.cfp.net/-/media/files/cfp-board/knowledge/reports-and-research/womens-initiative/building-wealth-insights-on-womens-aspirations-growing-financial-power.pdf [Accessed 11 October 2025].

Bank of America Institute, 2024. Women and Wealth 2024.

Bank of America Institute, 2024. Investing in Women insights [Online]. Available at: https://business.bofa.com/en-us/content/investing-in-women [Accessed 11 October 2025].

Pew Research Center, 2024. Rising educational attainment among young women has had positive economic effects [Online]. Available at: https://www.pewresearch.org/fact-tank/2024/04/23/rising-educational-attainment-among-young-women-has-had-positive-economic-effects/ [Accessed 11 October 2025].

Georgetown University Center on Education and the Workforce, 2021. The College Payoff [Online]. Available at: https://cew.georgetown.edu/cew-reports/the-college-payoff/ [Accessed 11 October 2025].